Research Report: New Rules for Supply Chain Insights, Collaboration and Overall Resiliency | 2020-10-01 | CSCMP's Supply Chain Quarterly

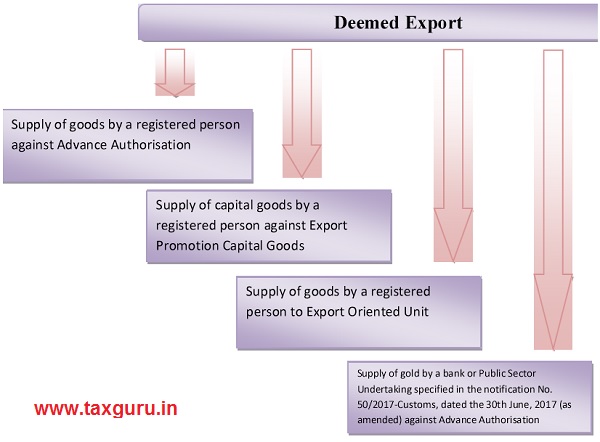

CESTAT | Services involving supply of goods/deemed supply of goods to be classified under 'works contract services' only | SCC Blog